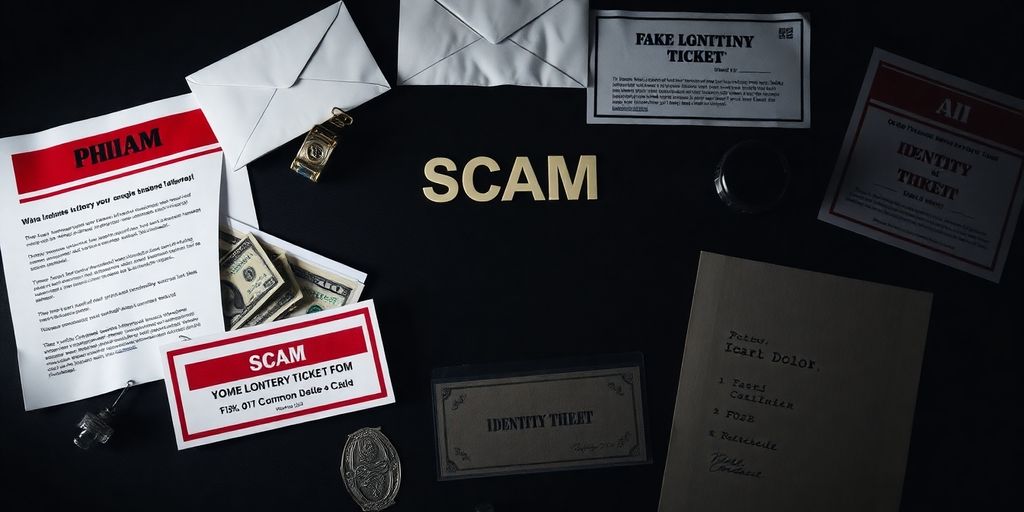

As we step into 2025, it’s clear that scams are becoming more sophisticated, often exploiting the latest technology and societal trends. With scammers raking in over $1 trillion in losses last year alone, it’s essential to stay informed. This article highlights ten alarming examples of scams you should be wary of in the coming year. Knowing what to look out for can help you protect yourself and your hard-earned money.

Key Takeaways

- Stay updated on the latest scams to protect yourself.

- Always verify the identity of anyone asking for personal information or money.

- Be cautious of offers that seem too good to be true; they often are.

- Use secure payment methods and double-check URLs when shopping online.

- Trust your instincts; if something feels off, it probably is.

1. AI Scams

Okay, so AI scams are the new thing, right? It’s like scammers have finally figured out how to use all this fancy tech to really mess with people. I saw something the other day that said some crazy amount of money, like over a trillion dollars globally, was lost to scams last year. And AI is just making it easier for these blokes to rip people off.

The thing is, AI can make scams way more believable.

Think about it. They can use AI to write emails that sound totally legit, create fake images, and even make deepfake videos. It’s getting harder and harder to tell what’s real and what’s not. The FBI even put out a warning about it, which is pretty serious.

It’s not just about dodgy emails anymore. Scammers are using AI to create entire fake identities and businesses. They can automate the whole process, targeting thousands of people at once. It’s a numbers game for them, and AI makes it way easier to play.

Here are some ways they’re using AI:

- Phishing and Smishing: AI can write super convincing emails and texts.

- Fake Images: They can whip up fake IDs and social media profiles in no time.

- Deepfake Videos: Used to promote fake products or even impersonate people.

It’s a bit scary, to be honest. You really have to be on your guard these days.

2. Imposter Scams

Imposter scams are super common because they’re so broad. Basically, someone pretends to be someone they’re not to trick you. This could be a fake friend, a supposed family member, or even someone claiming to be from the government. The goal is always to manipulate you into giving them money or personal information.

Think about it – anyone can create a fake profile online or make a phone call pretending to be someone else. It’s easier than ever for these scammers to reach a lot of people, and unfortunately, some people do fall for it. It’s not always about being gullible; sometimes, these scammers are just really good at what they do.

It’s important to remember that government agencies and legitimate businesses will almost never demand immediate payment or personal information over the phone or through email. If you’re ever unsure, hang up and contact the organisation directly using a verified phone number or website.

Here are a few things to keep in mind to protect yourself:

- Always verify the identity of someone contacting you, especially if they’re asking for money or personal information.

- Be wary of urgent requests or threats.

- Never give out personal information over the phone or email unless you initiated the contact.

3. Investment Scams

Investment scams are still doing the rounds, and they’re getting sneakier. It’s easy to get caught up in the hype, especially with everyone talking about the next big thing. But remember, if it sounds too good to be true, it probably is.

The main thing to remember is that scammers will try to pressure you into making quick decisions. They don’t want you to have time to think it over or talk to someone you trust. They might use fancy words or fake testimonials to make their scheme seem legit, but don’t fall for it.

Here are some things to watch out for:

- Promises of guaranteed high returns with little to no risk. Seriously, nothing is guaranteed in the investment world.

- Unsolicited investment offers, especially through social media or email.

- Pressure to invest quickly before the "opportunity" disappears.

I had a mate, Dave, who almost lost his shirt on one of these. He got sucked into some crypto thing that promised crazy returns. Luckily, his wife talked him out of putting all their savings in. Dodged a bullet there.

It’s always a good idea to do your homework before investing in anything. Check if the company is registered and regulated. Talk to a financial advisor. And most importantly, trust your gut. If something feels off, walk away.

4. Online Shopping Scams

Online shopping is so convenient, right? But it’s also a playground for scammers. They’re getting sneakier, and with more people buying stuff online, it’s easier than ever to get caught out. The key thing to remember is if a deal looks too good to be true, it probably is.

Scammers create fake websites that look just like the real deal, or they might list items on marketplaces with crazy low prices. You think you’re getting a bargain, but you either get nothing at all, or you receive something that’s nothing like what you ordered. Sometimes, they’re even using stolen credit card info to buy the item, which can cause a whole heap of trouble down the line.

Here’s what to watch out for:

- Dodgy URLs: Double-check the website address. Scammers often use slight variations of the real thing (e.g., "amaz0n.com" instead of "amazon.com").

- No contact info: If the website doesn’t have a proper "Contact Us" page or a physical address, that’s a red flag.

- Too-good-to-be-true prices: Seriously, if it seems way cheaper than anywhere else, be suspicious.

- Unsecured websites: Look for "https" in the URL and a padlock icon in the address bar. If it’s just "http," your information isn’t secure.

It’s a good idea to pay with a credit card or PayPal, as these often offer some protection if things go wrong. If you get scammed, contact your bank or payment provider straight away to see if you can get your money back.

5. Lottery Scams

Okay, so lottery scams are still doing the rounds, and honestly, they’re getting sneakier. It’s wild how many people still fall for these, but the scammers are good at what they do. Basically, you get a message – email, social media, whatever – telling you that you’ve won some massive lottery or sweepstakes. The catch? You didn’t even enter.

The main thing to remember is: if you didn’t buy a ticket, you didn’t win.

They’ll usually ask for some kind of upfront payment to cover "taxes" or "fees" before you can claim your winnings. Of course, once you send the money, they disappear faster than a snag at a barbie.

It’s easy to get caught up in the excitement of thinking you’ve won big, but always take a step back and ask yourself if it sounds too good to be true. Because, let’s be real, it probably is.

Here are some red flags to watch out for:

- You receive notification about winning a lottery you never entered.

- They ask you to pay fees upfront to claim your prize.

- The lottery claims to be run by the government (which is often a lie).

- The ticket is supposedly from a state or country that doesn’t even have a lottery.

- They tell you that paying a fee will increase your chances of winning (that’s not how lotteries work!).

6. Advance Fee Schemes

So, advance fee schemes are still kicking around in 2025, huh? You’d think people would have caught on by now, but these scammers are always finding new ways to trick people. Basically, it’s when someone asks you for money upfront with the promise of something big later on, and then they just vanish.

I remember my mate Barry almost got caught out by one of these a few years back. He was so excited about this "investment opportunity" he found online, but something felt off to me. Luckily, I managed to talk him out of sending any money before it was too late.

It’s easy to get caught up in the excitement of a potential windfall, but it’s important to stay grounded and do your research before handing over any money. If something seems too good to be true, it probably is.

Here’s a few things to watch out for:

- The Nigerian Prince Scam: Still going strong, apparently. Someone claiming to be a royal needs your help to get money out of the country, and they promise you a cut. Just ignore these emails, seriously.

- Fake Grants and Loans: They’ll say you’ve been approved for a grant or loan, but you need to pay a "processing fee" first. That fee goes straight into their pocket.

- Upfront Fees for Services: Be wary of anyone asking for money upfront for things like debt consolidation or credit repair. Often, they’ll take your money and do nothing.

The key thing to remember is that legitimate businesses don’t usually ask for large fees upfront. If someone is pressuring you to send money quickly, that’s a major red flag. Trust your gut, and don’t be afraid to say no.

7. Credit Card Scams

Credit card scams are still a big problem, and they’re getting more sophisticated. It’s not just about someone swiping your card at a dodgy ATM anymore; it’s about data breaches, phishing, and clever ways to trick you into handing over your details. Staying vigilant is key to protecting yourself.

I remember last year, my mate lost a bunch of money because he fell for one of those ‘lower your interest rate’ scams. Sounded legit, but it was a total con. He gave them his card details, and boom, his account was cleaned out. It’s a harsh reminder that if something sounds too good to be true, it probably is.

Here are a few things to keep in mind:

- Be wary of unsolicited offers: Whether it’s a phone call, email, or text, don’t trust anyone who contacts you out of the blue offering deals on your credit card. Always verify the source.

- Monitor your statements regularly: Check your credit card statements frequently for any suspicious activity. Even small, unfamiliar charges could be a sign of fraud.

- Protect your personal information: Never share your credit card details, PIN, or CVV number with anyone unless you’re absolutely sure they’re legitimate.

It’s a good idea to set up transaction alerts on your credit card. That way, you’ll get a notification every time a purchase is made, so you can quickly identify and report any fraudulent activity.

Data breaches are another big concern. Companies get hacked all the time, and your credit card information could be exposed. That’s why it’s important to:

- Use strong, unique passwords: Don’t use the same password for multiple accounts, and make sure your passwords are complex and difficult to guess.

- Be careful where you shop online: Only shop at reputable websites with secure payment gateways.

- Consider using a virtual credit card number: Some banks offer virtual credit card numbers, which are temporary numbers you can use for online purchases. This protects your actual credit card number from being exposed if a website is hacked.

8. Business Opportunity Scams

So, you’re thinking about starting your own business? Awesome! But hold your horses, because there are scammers out there just waiting to take advantage of your entrepreneurial spirit. These scams often promise big returns for little effort, and that’s usually the first red flag. If it sounds too good to be true, it probably is.

Here’s the thing, these scams come in different shapes and sizes. You might see something like a pyramid scheme disguised as a multi-level marketing opportunity, or maybe a franchise deal that’s just designed to bleed you dry. They’ll lure you in with promises of easy money and financial freedom, but in reality, you’ll end up losing your hard-earned cash.

Here are some things to watch out for:

- Upfront Fees: They want you to pay a hefty fee before you even start making money. Legit businesses usually don’t operate like that.

- Guaranteed Success: No business can guarantee success. If they’re promising you’ll get rich quick, run the other way.

- Pressure Tactics: They pressure you to sign up immediately, without giving you time to do your research. Take your time and think it through.

I remember my mate Dave got caught up in one of these things a few years back. He invested a bunch of money in a "revolutionary" cleaning product distributorship. Turns out, the product was rubbish, and he couldn’t sell it to anyone. He ended up stuck with a garage full of useless cleaning supplies and a whole lot less money in his bank account. Don’t be like Dave.

It’s always a good idea to do your homework before investing in any business opportunity. Check out the company’s reputation, read reviews, and talk to other people who have been involved. And if you’re still not sure, get some advice from a financial advisor or a business mentor. Better safe than sorry, right?

9. Romance Scams

Romance scams are still a thing, unfortunately. It’s easy to think you’re too smart to fall for one, but these scammers are getting really good at what they do. They play on your emotions and create a false sense of connection to get what they want – usually your money.

The basic idea is this: they create a fake online persona, reel you in with sweet talk and promises, and then start asking for money for some sob story. It could be for a medical emergency, travel expenses to come see you, or some other made-up crisis. The thing is, once you send the money, it’s gone, and so are they.

Here’s what to watch out for:

- They move fast. They’ll declare their love for you way too quickly, before they’ve even met you in person.

- Their story is full of inconsistencies. Pay attention to the details and see if things don’t quite add up.

- They avoid meeting in person. There’s always some excuse why they can’t travel to see you or video chat.

- They ask for money. This is the biggest red flag. Never send money to someone you’ve only met online, no matter how convincing their story is.

It’s important to remember that these scammers are professionals. They know how to manipulate people and exploit their emotions. If something feels off, trust your gut. It’s better to be safe than sorry when it comes to your heart and your wallet.

It’s a horrible thing to do, but it happens all the time. Don’t let it happen to you.

10. Phishing Scams

Phishing scams are still going strong, unfortunately. It’s where dodgy people try to trick you into giving up your personal information, like passwords or credit card details. They usually do this by pretending to be someone you trust, like your bank or even a friend. The goal is always the same: to steal your information for their own gain.

Think of it like this:

- You get an email that looks like it’s from your bank, saying there’s a problem with your account.

- You click on the link in the email, which takes you to a fake website that looks exactly like your bank’s website.

- You enter your username and password, and the scammers now have your login details.

It’s sneaky, and it’s getting harder to spot the fakes. Social media is a big playground for these scammers too. They might send you a message pretending to be a friend in need, or offer you a great deal on something. Always be careful before clicking on links or giving out any personal information.

It’s a good idea to double-check everything. If you get an email or message that seems suspicious, contact the company or person directly to confirm it’s legit. Don’t use the contact information in the suspicious message – find it yourself through a trusted source.

Stay Vigilant Against Scams

As we move into 2025, it’s clear that scams are not going anywhere. They’re just getting smarter, using new tech and tactics to trick people. The figures are staggering, with billions lost to these cons every year. It’s crucial to stay informed about the latest scams and be cautious with your personal information. Remember, if something seems too good to be true, it probably is. Keep your wits about you, do your research, and don’t hesitate to question offers that seem off. By staying alert and educated, you can protect yourself from falling victim to these scams.

Frequently Asked Questions

What are AI scams?

AI scams use advanced technology to trick people. Scammers create fake messages or voices that sound real, making it easier to deceive victims.

How can I spot an imposter scam?

Imposter scams happen when someone pretends to be someone else, like a friend or a company. Look out for unusual requests for money or personal information.

What should I do if I think I’ve been scammed?

If you think you’ve been scammed, report it to your local authorities and your bank. They can help you take steps to protect yourself.

How do investment scams work?

Investment scams promise high returns on investments that are too good to be true. Be cautious and research any investment opportunities before putting in money.

What are advance fee schemes?

Advance fee schemes ask for money upfront for a promised reward, like a lottery win or a loan. Most of the time, these are scams.

How can I protect myself from phishing scams?

To avoid phishing scams, don’t click on suspicious links in emails or messages. Always check the sender’s address and look for signs of fake websites.